Online payroll calculator 2021

The employer must reimburse the employee for the 25 gas expense. Use the calculator above to determine the cost of payroll taxes in your state per employee.

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

The online calculator is a straightforward ready reckoner that doesnt take into account other deductions which might apply.

. Whether your employees are hourly or on salary. You can use the calculator to compare your salaries between 2017 and 2022. 315000p in Aug 2022.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. Payroll taxes also include labor cost taxes Social Security taxes Medicare taxes and state and federal unemployment taxes. Austria 2022 Income Tax Calculator.

Online funds transfer. Heres our shortlist of the best stock brokers hand-picked by our experts. Injury and Illness Calculator.

Australian Payroll Association 2021 Payroll Benchmarking StudyCustomer support. Call or chat to an expert for QuickBooks Online Accountant QuickBooks Simple Start. Student Loan repayments and pension contributions can both alter the amount you take home or what you have to pay as an employer.

Extensive reporting allows generating reports in graphical and tabular form. Its extended customer service hours on weekdays and Saturdays are perfect if you want nearly round-the-clock assistance for payroll problems which. 010p in Aug 2022.

For employees with a reference date of 2 March 2021 calculate 80 of the average wages payable between 6 April 2020 or if later the date the employment started and the date before they were. Employer Paid Payroll Tax Calculator. Base Salary Signing Bonus Total Salary Adj.

Try it out today. Austria 2021 Income Tax Calculator. Paying employees and contractors is the most complex element of small business accountingYou have to produce checks and direct deposits that.

Enter your filing status income deductions and credits and we will estimate your total taxes. Austria 2020 Income Tax Calculator. Use our free check stub maker with calculator to generate pay stubs online instantly.

Simply input wage and W-4 information for each employee and our handy calculator will spit out gross pay net pay and deductions for Maryland and Federal taxes. The calculator is for reference only. Payroll taxes are first calculated according to your state as its your state that determines the rate at which youre taxed.

70 OFF for 3 months. Lowest price automated accurate tax calculations. For more specific guidance check out our Payroll services.

We designed a handy payroll tax calculator with you in mind. Just enter income and W-4 information for each employee and the calculator will take care of the rest. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

Certain government programs such as SBA loan programs and contracting opportunities are reserved for small businesses. Included with TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits. See Oklahoma tax rates.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Learn how you can find and get a copy of your W2 online for free during the 2021 2022 2023 tax filing season. This is a great payroll calculator for calculating current payroll costs and producing payroll cost forecast for employees in Austria to support business planning and business financial forecasts.

The assumption is that the employee is employed full-time and there are no additional charges. DH---- 2022 Payroll Totals Payroll Type Base Salary Signing Bonus Incentives Total Salary Total Adj. The calculator is updated with the tax rates of all Canadian provinces and territories.

Robert Reich former United States Secretary of Labor suggests lifting the ceiling on income subject to Social Security taxes which is 142800 as of 2021. Luckily our payroll tax calculator is here to lessen the burden of calculating payroll taxes so they almost seem free. In order to qualify businesses must satisfy SBAs definition of a small.

Ease in payroll taxing process ie withholding employees tax filing and paying tax as per regulations. Increase Social Security taxes. Usage of the Payroll Calculator.

Lift the payroll ceiling. The amount can be hourly daily weekly monthly or even annual earnings. First things first we have to pay the federal government.

Everyone loves paydayexcept payroll administrators. With self-service online payroll software starting at 1999 a month and full-service software starting at 2999 a month SurePayroll is one of the most affordable payroll systems in our top 10. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

It only takes a few seconds to calculate the right amount to deduct from each employees paycheck thus saving you time and providing peace of mind. The drivers new hourly rate is 575 after accounting for gas expenses. Miles and miles of reimbursement.

Producer Price Index - Final Demand. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. You can include your income Capital Gains Overseas Pensions Donations to charity and allowances for family members.

The payroll ceiling is now adjusted for inflation. PHP Payroll is a free employee attendance and payroll software specifically designed for medium and small enterprises. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 st January 2022 - 31 st December 2022.

Learn about the top trading platforms and get access to ETFs fractional shares research tools and more. 1040 Tax Estimation Calculator for 2022 Taxes. Enter your pay rate.

QuickBooks Time free online timesheet calculator helps calculate employee hours and gross pay on weekly or bi-weekly basis. We are NOT counting these against the active payroll. The table of size standards can also be found online in the small business size regulations set forth in the Electronic Code of Federal Regulations.

If workers and employers each paid 76 up from todays 62 it would. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Player 1 Age Pos.

Our 2022 payroll calculator allows companies and employees to estimate a net salary and total cost of labor including personal income tax owed PIT social security contributions and other taxes. Many companies including the military have made their employees W-2 forms easy to get online.

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Intuit Quickbooks Desktop Pro 2021 With Payroll Enhanced Windows

Payroll Calculator Free Employee Payroll Template For Excel

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

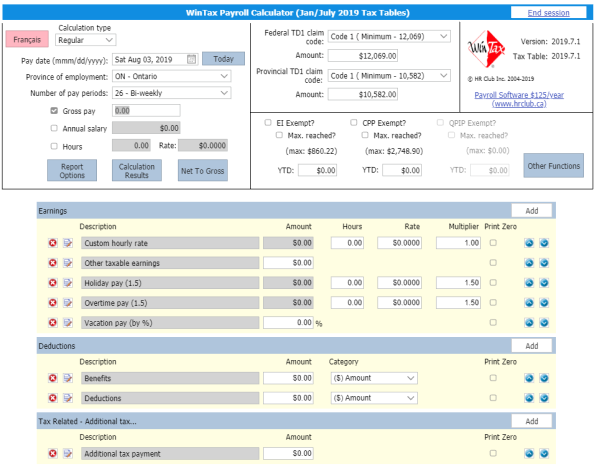

Wintax Calculator Wintax Canadian Payroll Software

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Attendance Sheet Template

Payroll Calculator With Pay Stubs For Excel

Free Time Card Calculator For Excel Templates Printable Free Card Templates Free Card Templates

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template